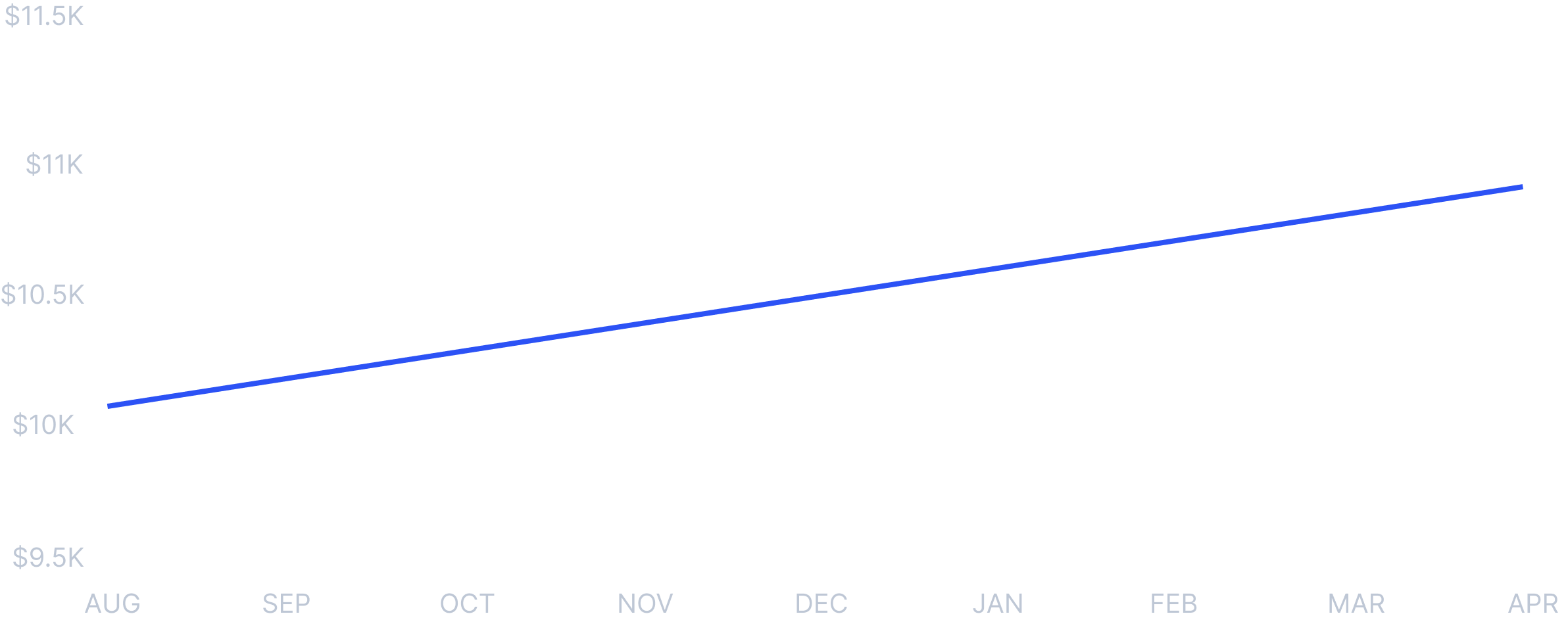

SINCE AUG 2023

Performance history

Based on an initial $10,000 investment in USDC, here’s a look at how the fund has been performing month-over-month, including distributions and investment value.

This data is for illustrative purposes. Past performance is not indicative of future results and may not be repeated.

Sector Diversification

We lend money to companies across a variety of industries. That way, if one sector underperforms, others can potentially offset losses.

Breakdown shown as at March 2024. Fund sector composition may change over time and chart may not be reflective of current composition.

Risk Management

Higher returns often come with higher risk. That’s why we carefully partnered with top-tier funds that only accept loans backed by real estate assets at 200%.

100%

Senior secured/first line credit

If a company runs into trouble, our fund is first in line to get paid back fully before other creditors.

200%

Overcollateralized loan

Loans are overcollateralized by 200% with real estate assets owned by the borrower company.

2.1x

Weighted average senior leverage

On average, companies will take 2.1 years to pay off debt based on their annual income.

Based on par value as of March 28, 2024