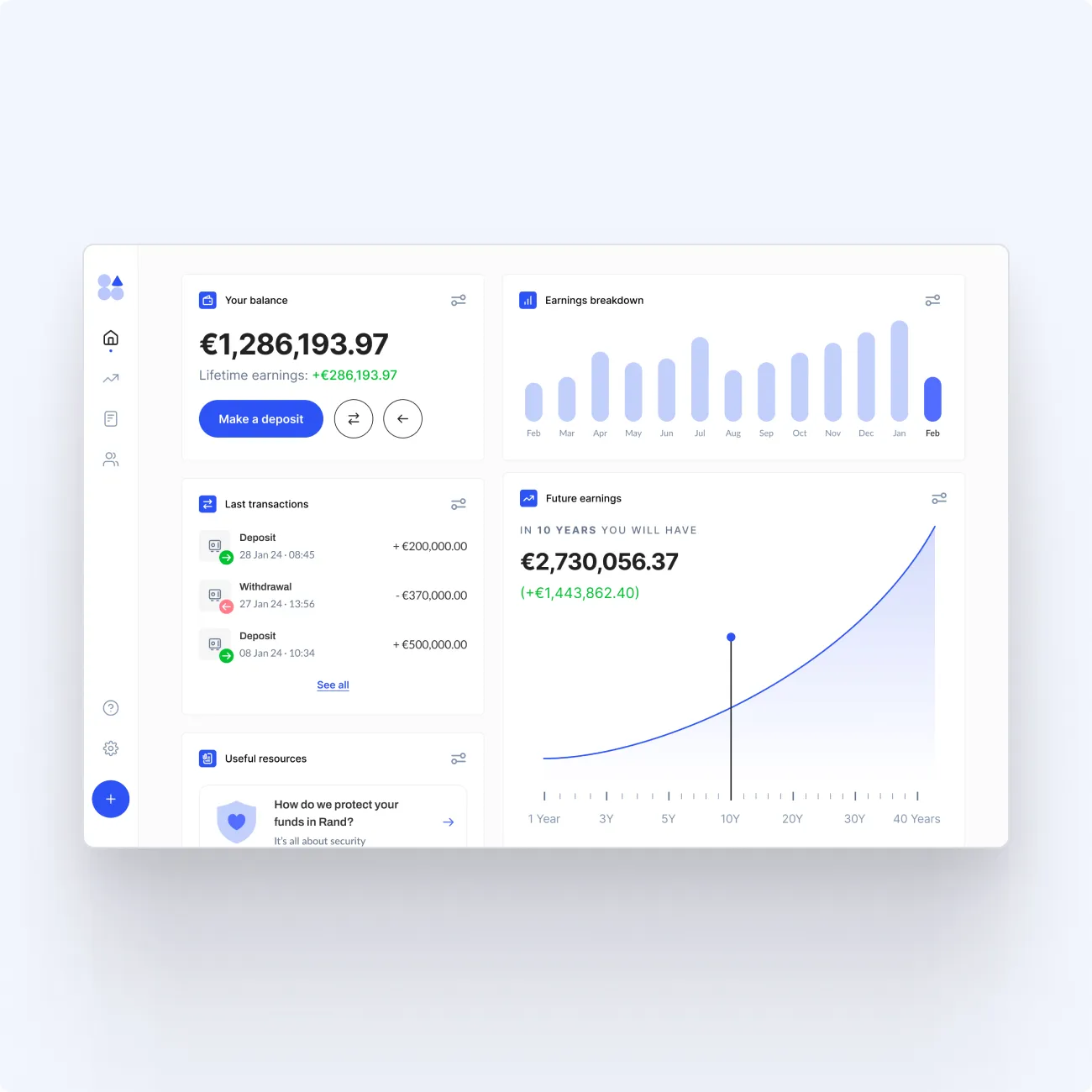

Extend your runway with up to 6.00% APY with our Business Earn account. All with zero wire fees and the highest level of security

Rand is a financial technology company, not a bank. Banking services are provided by Pecunia Cards. See your applicable agreement

here.